Let’s dig into the relative performance of Huron (NASDAQ:HURN) and its peers as we unravel the now-completed Q1 business process outsourcing & consulting earnings season.

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

The 7 business process outsourcing & consulting stocks we track reported a satisfactory Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 5.6% on average since the latest earnings results.

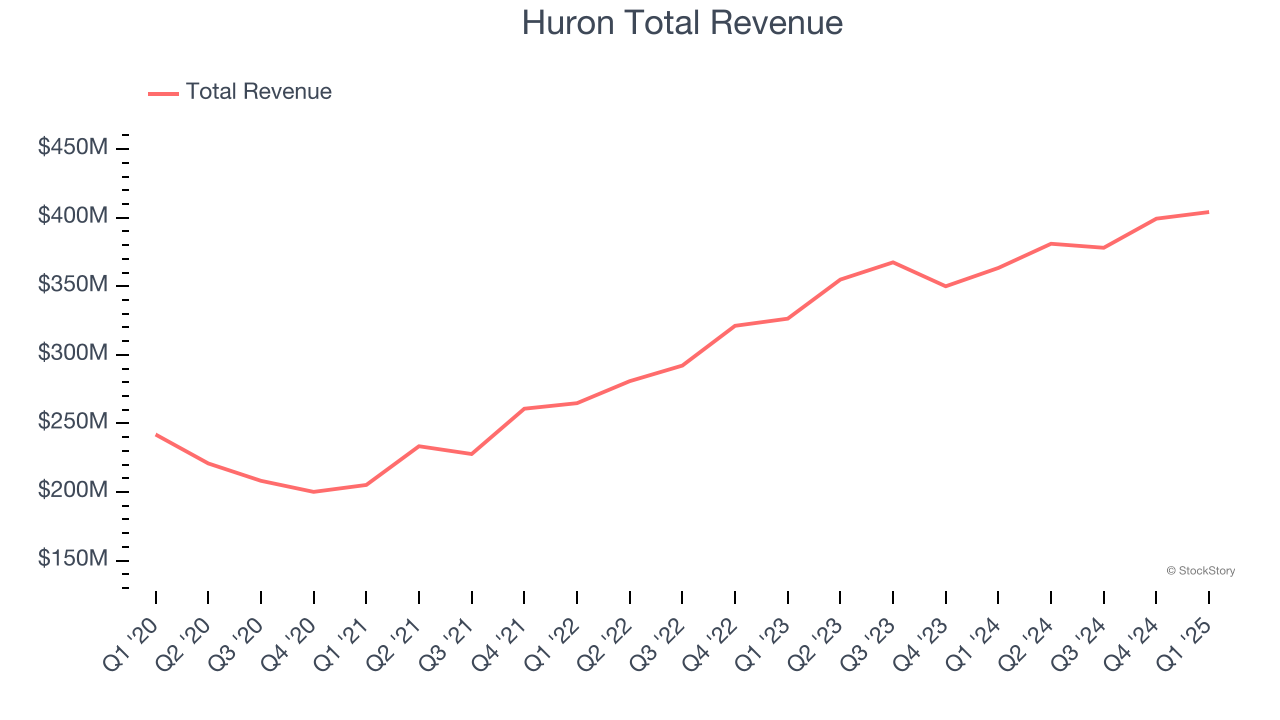

Huron (NASDAQ:HURN)

Founded in 2002 during a time of significant regulatory change in corporate America, Huron Consulting Group (NASDAQ:HURN) is a professional services company that helps organizations develop growth strategies, optimize operations, and implement digital transformation solutions.

Huron reported revenues of $404.1 million, up 11.2% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and a narrow beat of analysts’ full-year EPS guidance estimates.

“Driven by strong growth across all three operating segments, revenues before reimbursable expenses (RBR) grew 11% over the first quarter of 2024, while we continued to expand our margins,” said Mark Hussey, chief executive officer and president of Huron.

Interestingly, the stock is up 10.4% since reporting and currently trades at $150.10.

We think Huron is a good business, but is it a buy today? Read our full report here, it’s free.

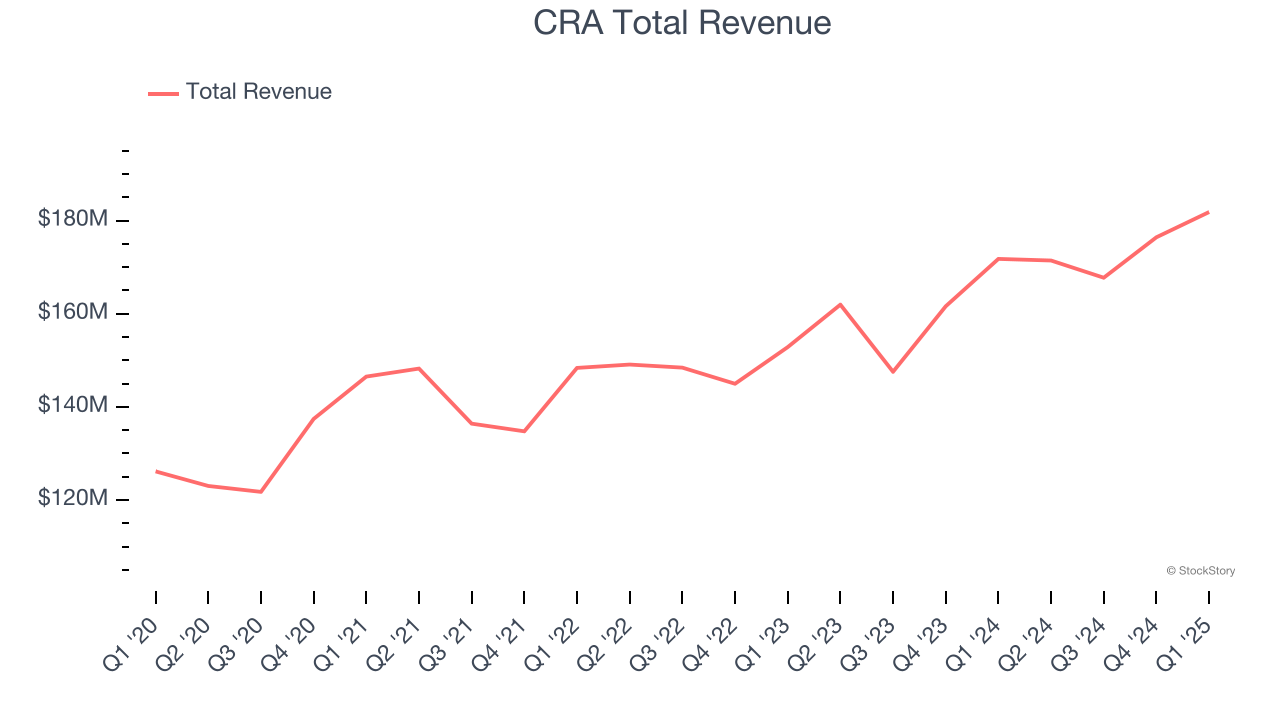

Best Q1: CRA (NASDAQ:CRAI)

Often retained for high-stakes matters with multibillion-dollar implications, CRA International (NASDAQ:CRAI) provides economic, financial, and management consulting services to corporations, law firms, and government agencies for litigation, regulatory proceedings, and business strategy.

CRA reported revenues of $181.9 million, up 5.9% year on year, outperforming analysts’ expectations by 3%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

CRA achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 21.2% since reporting. It currently trades at $195.43.

Is now the time to buy CRA? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Genpact (NYSE:G)

Originally spun off from General Electric in 2005 to provide business process services, Genpact (NYSE:G) is a global professional services firm that helps businesses transform their operations through digital technology, AI, and data analytics solutions.

Genpact reported revenues of $1.21 billion, up 7.4% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a slight miss of analysts’ EPS guidance for next quarter estimates.

Genpact delivered the weakest full-year guidance update in the group. As expected, the stock is down 13.1% since the results and currently trades at $43.06.

Read our full analysis of Genpact’s results here.

FTI Consulting (NYSE:FCN)

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting (NYSE:FCN) is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

FTI Consulting reported revenues of $898.3 million, down 3.3% year on year. This result came in 0.9% below analysts' expectations. Taking a step back, it was still a strong quarter as it logged an impressive beat of analysts’ EPS estimates.

FTI Consulting had the slowest revenue growth among its peers. The stock is flat since reporting and currently trades at $166.84.

Read our full, actionable report on FTI Consulting here, it’s free.

Exponent (NASDAQ:EXPO)

With a team of over 800 consultants holding advanced degrees in 90+ technical disciplines, Exponent (NASDAQ:EXPO) is a science and engineering consulting firm that investigates complex problems and provides expert analysis for clients across various industries.

Exponent reported revenues of $137.4 million, flat year on year. This number topped analysts’ expectations by 2.1%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EPS estimates.

The stock is up 3% since reporting and currently trades at $80.05.

Read our full, actionable report on Exponent here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.