Recent Articles from MarketMinute

MarketMinute is a dynamic online platform dedicated to delivering real-time stock news and market insights to investors and enthusiasts alike. Operated by FinancialContent, a leading digital publisher in financial news, the website offers up-to-the-minute updates on stock movements, corporate earnings, analyst ratings, and macroeconomic trends that shape the financial landscape.

Website: https://www.marketminute.com

WASHINGTON D.C. — The United States is once again hurtling toward a fiscal precipice as a looming midnight deadline on Friday, January 30, 2026, threatens to trigger a partial government shutdown. With less than four days remaining, a high-stakes standoff in the Senate over Department of Homeland Security (DHS) funding

Via MarketMinute · January 27, 2026

In a historic move that has sent shockwaves through global financial centers, spot gold prices officially breached the $5,000 per ounce milestone on January 26, 2026. This unprecedented ascent represents a 65% surge over the last calendar year, signaling a radical shift in investor sentiment as the "barometer of

Via MarketMinute · January 27, 2026

As of January 27, 2026, the financial world is witnessing a historic realignment that few saw coming eighteen months ago: silver has officially decoupled from its reputation as a "poor man's gold" to become the most sought-after industrial commodity of the artificial intelligence era. Last week, on January 23, the

Via MarketMinute · January 27, 2026

In a decisive move to solidify its leadership in the next generation of chronic inflammation and cardiometabolic treatments, Eli Lilly and Company (NYSE: LLY) announced the acquisition of Ventyx Biosciences (NASDAQ: VTYX) for approximately $1.2 billion. The all-cash deal, announced in early January 2026, values Ventyx at $14.00

Via MarketMinute · January 27, 2026

In a move that has sent shockwaves through both the Silicon Valley tech corridor and the Washington political establishment, Trump Media & Technology Group Corp. (NASDAQ: DJT) has officially announced a definitive merger agreement with fusion energy pioneer TAE Technologies. The deal, valued at more than $6 billion, represents a radical

Via MarketMinute · January 27, 2026

In a move that signals a tectonic shift in the enterprise software landscape, ServiceNow (NYSE: NOW) has announced its definitive agreement to acquire Armis, a leader in cyber exposure management, for approximately $7.75 billion in an all-cash transaction. This acquisition, the largest in ServiceNow's history, marks a bold departure

Via MarketMinute · January 27, 2026

In a move that signals a massive shift toward real-time operational intelligence, International Business Machines Corp. (NYSE: IBM) has moved to acquire Confluent, Inc. (NASDAQ: CFLT) in an all-cash transaction valued at approximately $11 billion. The deal, announced in late 2025 and currently progressing through final regulatory milestones as of

Via MarketMinute · January 27, 2026

In a move that has sent shockwaves through the healthcare sector, Boston Scientific Corporation (NYSE: BSX) announced on January 15, 2026, its definitive agreement to acquire Penumbra, Inc. (NYSE: PEN) for approximately $14.5 billion. The deal represents one of the most significant consolidations in the history of the medical

Via MarketMinute · January 27, 2026

As of January 27, 2026, the American financial landscape is undergoing its most significant transformation since the dawn of electronic banking. The "Guiding and Establishing National Innovation for U.S. Stablecoins" (GENIUS) Act, signed into law on July 18, 2025, has successfully moved from a legislative milestone to a functioning

Via MarketMinute · January 27, 2026

As of January 27, 2026, the Securities and Exchange Commission (SEC) is undergoing its most radical transformation in decades. Under the leadership of Chairman Paul Atkins, who was confirmed in April 2025, the agency has pivoted from a posture of aggressive "regulation by enforcement" to a philosophy centered on capital

Via MarketMinute · January 27, 2026

The healthcare sector was rocked this week as the Centers for Medicare & Medicaid Services (CMS) released its highly anticipated 2027 Advance Notice, proposing a base payment rate increase that fell staggeringly short of industry expectations. The announcement has sent major insurers into a tailspin, erasing approximately $80 billion in market

Via MarketMinute · January 27, 2026

In a pivotal moment for the American automotive landscape, General Motors (NYSE: GM) released its fourth-quarter and full-year 2025 earnings on January 27, 2026, unveiling what analysts are calling "The Great Recalibration." The Detroit giant delivered a staggering beat on adjusted earnings per share, reporting $2.51 against Wall Street

Via MarketMinute · January 27, 2026

On January 27, 2026, The Boeing Company (NYSE: BA) released its fourth-quarter and full-year 2025 financial results, marking a historic, albeit complex, milestone for the aerospace giant. After years of financial bleeding, safety crises, and labor unrest, Boeing reported its first annual net profit in seven years. The results signal

Via MarketMinute · January 27, 2026

The Dow Jones Industrial Average faced a significant headwind today, as shares of UnitedHealth Group (NYSE: UNH) experienced their worst single-day sell-off in over three decades. The collapse, which wiped out approximately $60 billion in market value, followed the Trump administration’s proposal of a nearly flat payment rate for

Via MarketMinute · January 27, 2026

As Wall Street turns its gaze toward Cupertino, Apple Inc. (NASDAQ:AAPL) is preparing to release its fiscal first-quarter earnings report on Thursday, January 29, 2026. The announcement comes at a pivotal moment for the tech giant, which has spent much of the past year navigating a transition into a

Via MarketMinute · January 27, 2026

As the sun sets on January 27, 2026, the financial world has its eyes fixed firmly on Austin, Texas. Tomorrow, Tesla (NASDAQ: TSLA) will release its fourth-quarter earnings report for 2025, a document that arrives at perhaps the most pivotal moment in the company’s twenty-year history. After a year

Via MarketMinute · January 27, 2026

As Meta Platforms (NASDAQ: META) prepares to release its fourth-quarter 2025 earnings report on January 28, the Silicon Valley giant finds itself at a historic crossroads. After a year of aggressive pivoting and "Founder Mode" execution, CEO Mark Zuckerberg is set to present a balance sheet that reflects both the

Via MarketMinute · January 27, 2026

As the closing bell approaches on January 27, 2026, the global financial community has fixed its gaze on Redmond. Tomorrow, Microsoft (NASDAQ: MSFT) is scheduled to release its fiscal second-quarter 2026 earnings report, an event that has become the definitive pulse check for the artificial intelligence revolution. With the company’

Via MarketMinute · January 27, 2026

On the eve of the Federal Open Market Committee’s (FOMC) first policy decision of 2026, a heavy silence has fallen over Wall Street. As of today, January 27, 2026, investors are positioning themselves for what is widely expected to be a pivotal interest rate announcement on Wednesday, January 28.

Via MarketMinute · January 27, 2026

The U.S. stock market reached a historic milestone on January 27, 2026, as the S&P 500 (NYSEARCA:SPY) climbed to a fresh all-time high of 6,980.75, tantalizingly close to the psychologically significant 7,000 level. Driven by a surge in the Nasdaq Composite (NASDAQ:QQQ), which

Via MarketMinute · January 27, 2026

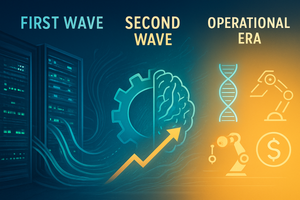

As of January 27, 2026, the global financial markets are witnessing a profound transformation in the artificial intelligence narrative. While 2023 and 2024 were defined by a "land grab" for semiconductor chips and massive data center construction, the narrative in early 2026 has shifted toward the "Second Wave": a period

Via MarketMinute · January 27, 2026

The global consumer staples giant Procter & Gamble (NYSE:PG) reported its second-quarter fiscal 2026 results this week, revealing a business locked in a struggle against a macroeconomic climate that management has bluntly described as "frigid." While the company managed to maintain its top-line revenue through strategic pricing, a telling 1%

Via MarketMinute · January 27, 2026

As the first month of 2026 draws to a close, the financial world is recalibrating its expectations following a blockbuster market outlook from JPMorgan Chase & Co. (JPM/NYSE). Released this January, the firm’s 2026 forecast projects a year of significant expansion for global equities, predicting double-digit gains fueled by

Via MarketMinute · January 27, 2026

As the Federal Reserve stabilizes interest rates in the 3.50% to 3.75% target range this January 2026, a significant shift is rippling through the equity markets, favoring the long-overlooked small-cap sector. For nearly two years, smaller enterprises have buckled under the weight of "higher-for-longer" monetary policy, but the

Via MarketMinute · January 27, 2026

As of January 27, 2026, the financial landscape has undergone a dramatic transformation. After a prolonged "deal winter" that chilled the markets through 2023 and much of 2024, the small-cap sector is currently witnessing an unprecedented resurgence in Mergers and Acquisitions (M&A). This revival is being fueled by a

Via MarketMinute · January 27, 2026

In a move that has significantly calmed global markets and redirected the course of Arctic geopolitics, the Trump administration officially unveiled its updated "Joint Arctic Security & Resource Framework" for Greenland. Announced on January 21, 2026, at the World Economic Forum in Davos, the new policy represents a strategic pivot from

Via MarketMinute · January 27, 2026

In a demonstration of operational resilience, Union Pacific (NYSE:UNP) reported its fourth-quarter 2025 financial results today, January 27, 2026, revealing a 5% increase in net income despite a notable decline in shipping volumes. The Omaha-based railroad giant posted a net income of $1.8 billion, or $3.11 per

Via MarketMinute · January 27, 2026

In a resounding signal of the "AI power boom" taking hold of the energy sector, NextEra Energy (NYSE:NEE) reported a significant jump in fourth-quarter net income today, January 27, 2026, surpassing analyst expectations and setting a confident tone for the year ahead. The clean energy giant posted a GAAP

Via MarketMinute · January 27, 2026

NEW BRUNSWICK, N.J. — Johnson & Johnson (NYSE: JNJ) has officially closed the chapter on a year many analysts described as "transitional," reporting full-year 2025 earnings that met expectations while setting a bold trajectory for the year ahead. In its January 21, 2026, earnings call, the healthcare titan revealed it is

Via MarketMinute · January 27, 2026

On January 22, 2026, GE Aerospace (NYSE:GE) released a fourth-quarter and full-year 2025 earnings report that, by almost any traditional metric, signaled a company at the absolute zenith of its operational powers. The aerospace giant reported a robust 18% year-over-year revenue increase to $45.9 billion for the full

Via MarketMinute · January 27, 2026

On January 20, 2026, United Airlines (NASDAQ:UAL) reported fourth-quarter 2025 financial results that underscored a deepening divide in the aviation industry. While the carrier achieved its highest quarterly revenue in history, reaching $15.4 billion, the engine of this growth was not the traditional back-of-the-plane traveler. Instead, a surge

Via MarketMinute · January 27, 2026

SANTA CLARA, CA — Shares of Intel Corporation (Nasdaq: INTC) plummeted more than 17% following its fourth-quarter 2025 earnings report, as a dismal outlook for the first quarter of 2026 shattered investor confidence in the semiconductor giant's turnaround timeline. Despite a modest beat on top and bottom-line figures for the final

Via MarketMinute · January 27, 2026

On January 27, 2026, General Motors (NYSE:GM) signaled a definitive end to the "all-in" electric vehicle era that had defined its corporate strategy for the previous half-decade. In a sweeping fourth-quarter earnings report, the Detroit giant announced a massive $7.2 billion special charge related to a strategic "realignment"

Via MarketMinute · January 27, 2026

The United States economy has defied the skeptics once again, reporting a robust 4.4% annualized growth rate for the third quarter of 2025. This significant beat, revealed in delayed data released this week, has sent a wave of optimism through Wall Street. By pairing high-octane growth with Personal Consumption

Via MarketMinute · January 27, 2026

As of January 27, 2026, the long-anticipated "Earnings Handoff" has officially moved from a theoretical market forecast to a tangible reality. After years of dominance by a handful of mega-cap technology titans, the primary engine of profit growth in the U.S. equity market is shifting toward the broader, domestically

Via MarketMinute · January 27, 2026

As the final week of January 2026 unfolds, the financial world is bracing for a collision of data points that will likely define the market's trajectory for the first half of the year. While the "Magnificent 7" tech giants are preparing to unveil their multi-billion dollar AI investments, it is

Via MarketMinute · January 27, 2026

As the sun sets on the first month of 2026, all eyes in the financial world are fixed on Cupertino. On Thursday, January 29, 2026, Apple Inc. (NASDAQ: AAPL) is set to release its fiscal first-quarter results for the 2025 holiday season—a report that many analysts believe will be

Via MarketMinute · January 27, 2026

PALO ALTO, Jan 27, 2026 — Tesla, Inc. (NASDAQ: TSLA) is preparing to release its fourth-quarter 2025 earnings report tomorrow, January 28, in what many analysts are calling the most pivotal moment for the company in years. The report, scheduled to drop after the market close, comes at a time of

Via MarketMinute · January 27, 2026

As the financial world braces for a pivotal week of economic data and corporate disclosures, Meta Platforms, Inc. (NASDAQ: META) has seized the spotlight with a commanding 4.22% stock surge. This rally, occurring just days before the company is slated to report its fourth-quarter 2025 results, underscores a significant

Via MarketMinute · January 27, 2026

As the tech world braces for Microsoft’s (NASDAQ: MSFT) Q2 fiscal year 2026 earnings report scheduled for tomorrow, January 28, the company finds itself at a pivotal crossroads. Once the undisputed darling of the artificial intelligence (AI) gold rush, the Redmond giant is now entering a "valuation reset" phase

Via MarketMinute · January 27, 2026

The digital asset market faced a harsh reality check this week as Bitcoin (BTC) shed months of gains, tumbling to a three-month low near $92,400. The plunge, which caught many over-leveraged traders off-guard, effectively erased the optimism that had characterized the start of 2026. This sudden reversal from the

Via MarketMinute · January 27, 2026

As investors and analysts navigate the geopolitical turbulence of early 2026, the market is casting a wary eye back at the "Spring Sell-Off" of 2025—a period that fundamentally reshaped the trajectory of the world’s most powerful technology companies. This time last year, the "Magnificent 7" saw a collective

Via MarketMinute · January 27, 2026

As of January 27, 2026, the global financial landscape is witnessing a historic realignment as gold prices surged past the unprecedented $5,000 per ounce threshold. This morning, spot gold reached an intraday high of $5,111.11, marking a definitive shift in investor sentiment away from traditional equities and

Via MarketMinute · January 27, 2026

In a dramatic shift of market sentiment, the yield on the 10-year U.S. Treasury note tumbled to monthly lows in late February 2025, as a flurry of disappointing economic data and intensifying geopolitical tensions sparked fears of a significant domestic slowdown. After peaking near 4.79% in mid-January, the

Via MarketMinute · January 27, 2026

As the calendar turned toward the final days of February 2025, the narrative surrounding Nike, Inc. (NYSE: NKE) underwent a seismic shift that continues to resonate across the athletic apparel landscape today. For nearly two years, the Oregon-based giant had been mired in a "valuation trough," struggling with an over-reliance

Via MarketMinute · January 27, 2026

The release of soft manufacturing sector data in early March 2025 has sent shockwaves through global financial markets, transforming early-year optimism into a profound "recession scare." As the Institute for Supply Management (ISM) and S&P Global published their respective Purchasing Managers' Indices (PMI), investors were confronted with a dual-threat

Via MarketMinute · January 27, 2026

As the calendar turns to the final days of January 2026, the financial world is bracing for a critical litmus test of the American economy. In the coming weeks, retail titans Target (NYSE: TGT) and Costco (NASDAQ: COST) are set to release their latest quarterly earnings, offering a high-definition look

Via MarketMinute · January 27, 2026

The American consumer, long the indomitable engine of the global economy, appears to be finally losing steam. Fresh data released in late January 2026 confirms a sobering reality: U.S. consumer spending has fallen by its widest margin in four years, mirroring the structural weaknesses first glimpsed during the "Valentine’

Via MarketMinute · January 27, 2026

As the Federal Reserve convenes this week for its January 27–28 policy meeting, the financial world is looking past the central bank’s expected "hold" decision toward a critical data point: the February nonfarm payrolls report. Scheduled for release on February 6, 2026, this report is anticipated to reveal

Via MarketMinute · January 27, 2026

The semiconductor industry, the undisputed engine of the global economy for the past three years, is facing a stark reality check as January 2026 draws to a close. What began as a triumphant year-end for high-flyers like Broadcom Inc. (Nasdaq: AVGO) has curdled into a period of intense volatility, triggered

Via MarketMinute · January 27, 2026

February 2025 proved to be a sobering month for U.S. equity markets, as a "perfect storm" of macroeconomic pressures brought an abrupt end to the multi-month rally that had defined the turn of the year. The tech-heavy Nasdaq Composite led the retreat, falling approximately 4% and marking its steepest

Via MarketMinute · January 27, 2026

In a pivotal turn of events for the AI infrastructure sector, Super Micro Computer (Nasdaq: SMCI) has successfully averted a catastrophic delisting from the Nasdaq exchange by filing its long-overdue financial reports. As of January 27, 2026, the company is back in full regulatory compliance, marking the end of a

Via MarketMinute · January 27, 2026

The era of uncontested dominance for Tesla, Inc. (NASDAQ: TSLA) in the European Union appears to have hit a significant roadblock. On Tuesday, January 27, 2026, shares of the Austin-based automaker plummeted by 8%, following a series of data releases from the European Automobile Manufacturers' Association (ACEA) that confirmed a

Via MarketMinute · January 27, 2026

As the financial markets navigate a precarious start to 2026, investors are increasingly looking toward the retail sector as a stabilizing force. This trend echoes the remarkable market performance of late February 2025, when retail giants emerged as the primary "bright spot" for the Dow Jones Industrial Average, providing a

Via MarketMinute · January 27, 2026

As the financial world approaches the one-year anniversary of the most volatile period in recent defense-tech history, investors remain haunted by the specter of "Black Monday" in February 2025. On February 24, 2025, shares of Palantir Technologies (NYSE: PLTR) plummeted 10.5% in a single trading session, wiping out billions

Via MarketMinute · January 27, 2026

As the financial world settles into the first month of 2026, the shadow of Warren Buffett’s final masterstroke continues to loom large over the markets. Following the legendary investor’s retirement on December 31, 2025, the investment community is reflecting on the financial fortress he left for his successor,

Via MarketMinute · January 27, 2026

As the financial world closes the books on January 2026, market participants are casting a wary eye toward the upcoming February economic calendar. One year ago, the University of Michigan Consumer Sentiment Index recorded a staggering drop to 64.7, a figure that has since become a benchmark for the

Via MarketMinute · January 27, 2026

The release of the January Core Personal Consumption Expenditures (PCE) price index has provided a much-needed breath of fresh air for Wall Street, signaling that the Federal Reserve’s long battle against inflation may finally be entering its final act. The data, which arrived during a period of heightened geopolitical

Via MarketMinute · January 27, 2026

As of January 1, 2026, the European Union has officially entered the "definitive phase" of its Carbon Border Adjustment Mechanism (CBAM), ending the era of carbon-free imports for energy-intensive commodities. For the first time, importers of steel, aluminium, cement, electricity, fertilizers, and hydrogen must account for the carbon footprint of

Via MarketMinute · January 27, 2026

On March 3, 2025, the relative calm of the North American trade landscape was shattered by a midday announcement from the Roosevelt Room. President Donald Trump, citing a national emergency under the International Emergency Economic Powers Act (IEEPA), declared the immediate implementation of sweeping tariffs on goods imported from Canada

Via MarketMinute · January 27, 2026

As of January 27, 2026, the global agricultural landscape remains tethered to the volatile rhythm of the Black Sea. After years of disruption, the region has entered a state of "bearish stability"—a fragile equilibrium where ample 2025 harvests meet intensifying logistical risks. While wheat and corn prices have retreated

Via MarketMinute · January 27, 2026

Exactly one year ago, the financial world witnessed a seismic shift that redefined the artificial intelligence era. In late February 2025, following a highly anticipated earnings release, NVIDIA Corporation (NASDAQ: NVDA) experienced a historic single-day market cap loss that eventually peaked at a staggering $600 billion in value destruction. This

Via MarketMinute · January 27, 2026

As of January 27, 2026, the European aluminum market has entered a period of intense volatility, with prices for aluminum scrap and secondary ingots surging to multi-year highs. This "supply-side squeeze" is being driven by a perfect storm of factors: a structural shortage of domestic scrap generation, an industrial downturn

Via MarketMinute · January 27, 2026

In a decisive move to break China’s long-standing stranglehold on the global critical minerals market, the U.S. government announced a landmark $1.6 billion investment package on January 26, 2026. This massive capital infusion, directed primarily toward domestic "mine-to-magnet" infrastructure, represents the most significant federal intervention in the

Via MarketMinute · January 27, 2026

The global copper market has entered a transformative era, driven by a "perfect storm" of surging demand from artificial intelligence (AI) data centers and a series of catastrophic supply shocks at major traditional mines. As of late January 2026, copper prices have stabilized near a historic $5.91 per pound,

Via MarketMinute · January 27, 2026

In a move that underscores the deepening energy alliance between the United Arab Emirates and the United States, the Abu Dhabi National Oil Company (ADNOC) has significantly increased its equity position in the Rio Grande LNG project in Brownsville, Texas. On January 26, 2026, ADNOC—operating through its newly branded

Via MarketMinute · January 27, 2026

In a move that has sent shockwaves through the global mining industry, Zijin Mining Group Co., Ltd. (HKG: 2899), through its subsidiary Zijin Gold International, announced on January 26, 2026, a definitive agreement to acquire Allied Gold Corp. (TSX: AAAU) in an all-cash transaction valued at approximately US$4 billion

Via MarketMinute · January 27, 2026

In a volatile trading session that has stunned energy analysts, U.S. natural gas futures skyrocketed nearly 28% on Tuesday, January 27, 2026, settling at $6.78 per million British thermal units (MMBtu). The massive price jump marks one of the most significant single-day gains in the history of the

Via MarketMinute · January 27, 2026

In a move that has sent shockwaves through the global financial landscape, silver prices staged a historic "black swan" rally on January 26, 2026, surging nearly 12% in a single day to reach a record settlement of $113 per ounce. This parabolic move, fueled by a perfect storm of physical

Via MarketMinute · January 27, 2026

The global financial landscape reached a staggering milestone on January 26, 2026, as gold prices surged past the $5,000 per ounce mark for the first time in history. The precious metal, long considered the ultimate safe-haven asset, witnessed a dramatic daily rip of 1.41% to 1.95%, signaling

Via MarketMinute · January 27, 2026

As of January 27, 2026, the global financial architecture is undergoing a seismic shift, with gold re-emerging as the primary arbiter of value in a fractured geopolitical landscape. Driven by the escalation of the "Greenland Trade War" and a systematic pivot away from the U.S. dollar, central banks and

Via MarketMinute · January 27, 2026

As of January 27, 2026, the global financial landscape has been reshaped by a historic bull run in precious metals. While the spot price of gold has shattered records to trade above $5,100 per ounce, it is the equities—the companies that pull the metal from the earth—that

Via MarketMinute · January 27, 2026

As of January 27, 2026, the global financial landscape has been fundamentally reshaped by what analysts are calling the "Great Revaluation." Gold has shattered psychological barriers to trade at a staggering $5,100 per ounce, while silver has outpaced its yellow counterpart, surging past $110 per ounce. This unprecedented bull

Via MarketMinute · January 27, 2026

On January 26, 2026, the global commodities market witnessed a historic upheaval as silver prices catapulted to an all-time high of $115.08 per ounce. The white metal staged a staggering 14% single-day surge, marking its most explosive 24-hour gain since 1985. This parabolic move has sent shockwaves through financial

Via MarketMinute · January 27, 2026

The global financial landscape underwent a seismic shift on Monday, January 26, 2026, as gold prices surged past the once-unthinkable $5,000 per ounce barrier. Spot gold hit an all-time high of $5,093.15 per ounce, fueled by a perfect storm of domestic political paralysis and an increasingly aggressive

Via MarketMinute · January 27, 2026