Latest News

Shares of bitcoin development company Strategy (NASDAQ:MSTR) jumped in the morning session after the price of Bitcoin, a key asset for the company, experienced notable gains. MicroStrategy's stock performance was closely linked to the cryptocurrency market because the company held a large amount of Bitcoin. The digital currency traded around the $88,000 level following recent gains and weeks of fluctuations. Although it showed upward momentum, Bitcoin met resistance near the $90,000 mark. The price touched $89,893 before it started to decrease, but the overall positive trend appeared to lift investor sentiment for the software company.

Via StockStory · December 22, 2025

Shares of behavioral health company Acadia Healthcare (NASDAQ:ACHC)

jumped 2% in the morning session after a survey from research firm Cantor Fitzgerald highlighted strengthening healthcare volumes and provider optimism for future revenue and profit. The firm's fourth-quarter Private Hospital Executive Survey indicated that both inpatient and outpatient volumes were trending positively toward the end of 2025. This data suggested that full-year guidance for healthcare providers appeared achievable. The positive outlook for the sector seemed to boost investor confidence, signaling that broader industry trends were favorable for the company's performance in the upcoming year.

Via StockStory · December 22, 2025

Via Benzinga · December 22, 2025

Shares of scientific instrument company Bruker (NASDAQ:BRKR).

jumped 4.7% in the morning session after a company it majority-owns, RI Research Instruments, announced it had won orders valued at approximately €35 million.

Via StockStory · December 22, 2025

Shares of satellite communications provider jumped 7.3% in the morning session after the stock's positive momentum continued as the company was added to the S&P 600 index, a list of small-cap companies. This change came as part of an index rebalancing where Iridium was moved from the S&P 400 Communication Services index. The move to the S&P 600 was significant because investment funds that track this index were then required to buy shares of Iridium to properly mirror the index's holdings. This mandatory buying from institutional funds created increased demand for the stock, which in turn pushed its price higher.

Via StockStory · December 22, 2025

Larry Ellison will personally guarantee the $40 billion in equity financing in Paramount's latest offer for Warner Bros. Discovery.

Via Investor's Business Daily · December 22, 2025

Shares of digital medical services platform Teladoc Health (NYSE:TDOC) jumped 2.8% in the morning session after Barclays initiated coverage on the company with an Equal Weight rating and an $8.50 price target.

Via StockStory · December 22, 2025

Shares of voice AI technology company SoundHound AI (NASDAQ:SOUN) jumped 2.7% in the morning session after analysts from Cantor Fitzgerald and Mizuho Securities upgraded the stock to a "Buy" rating.

Via StockStory · December 22, 2025

Shares of enterprise AI software company C3.ai (NYSE:AI) jumped 3.2% in the morning session after the stock's positive momentum continued as the U.S. Army partnered with the company to enhance its logistics planning using advanced artificial intelligence tools.

Via StockStory · December 22, 2025

Via Benzinga · December 22, 2025

As the clock winds down on 2025, the United States economy presents a jarring paradox that has left economists and everyday citizens at odds. On one hand, the "soft landing" long promised by the Federal Reserve appears to have been achieved, with the nation avoiding a technical recession despite a

Via MarketMinute · December 22, 2025

Howmet Aerospace Inc. (NYSE: HWM) to acquire Consolidated Aerospace Manufacturing from Stanley Black & Decker for $1.8B.

Via Benzinga · December 22, 2025

Asian equity markets surged to historic levels on Monday, December 22, 2025, riding a wave of optimism from a significant late-week rally in U.S. technology stocks. The regional advance was further amplified by a weakening Japanese Yen, which, despite recent interest rate hikes, continues to provide a competitive edge

Via MarketMinute · December 22, 2025

As the sun sets on 2025, a year defined by geopolitical "tariff shocks" and a persistent "AI bubble scare," the Vanguard Total Stock Market ETF (NYSE Arca: VTI) has emerged as the definitive barometer for American retail sentiment. On December 22, 2025, the fund and its broader Vanguard ecosystem witnessed

Via MarketMinute · December 22, 2025

Hot stocks can only get hotter -- year after year after year.

Via The Motley Fool · December 22, 2025

Discover the catalyst that could reshape the EV industry and push QuantumScape into its most important chapter yet.

Via The Motley Fool · December 22, 2025

As the sun sets on a tumultuous 2025, the financial markets are entering the final full trading week of the year with a mix of festive optimism and calculated institutional maneuvering. On this Monday, December 22, 2025, the major indices are hovering near record highs, with the S&P 500

Via MarketMinute · December 22, 2025

As 2025 draws to a close, the financial narrative of the year has shifted from the hardware that powers artificial intelligence to the software that monetizes it. While the tech rally of the early 2020s was defined by the relentless climb of semiconductor giants, a new titan has emerged from

Via MarketMinute · December 22, 2025

In a move that cements one of the most dramatic corporate turnarounds in recent history, Carvana Co. (NYSE: CVNA) officially joined the S&P 500 Index today, December 22, 2025. The inclusion marks the final chapter of the online used-car retailer’s journey from the brink of insolvency in 2022

Via MarketMinute · December 22, 2025

Via Benzinga · December 22, 2025

Clearwater Analytics shares are trading higher Monday after Permira and Warburg Pincus agreed to acquire the company in an $8.4 billion deal.

Via Benzinga · December 22, 2025

Heritage Commerce (HTBK) is trading at new two-year highs. Shares are up more than 30% over the past year and demonstrate strong momentum. HTBK maintains a 100% “Buy” opinion from Barchart. The stock has strong fundamentals, but caution is advised to...

Via Barchart.com · December 22, 2025

Gold, silver, platinum, and palladium are building upon last week's gains and rallying again this morning -- in a big way.

Via Talk Markets · December 22, 2025

Should you buy the one Quantum Computing stock that is down in 2025?

Via The Motley Fool · December 22, 2025

As the trading year of 2025 draws to a close, Palantir Technologies (NYSE:PLTR) finds itself at a critical technical and fundamental crossroads. After a year defined by explosive growth and a transformation from a niche defense contractor into a global software powerhouse, the stock is currently consolidating near key

Via MarketMinute · December 22, 2025

Shares of Quantum Computing Inc. (NASDAQ: QUBT) jumped more than 11% today, December 22, 2025, as the company continues to solidify its position as a frontrunner in the race to commercialize quantum-enhanced technologies. The rally comes on the heels of a series of strategic maneuvers, including the finalization of its

Via MarketMinute · December 22, 2025

Morgan Stanley says SNX is one of their top "Overweight" positions going into the new year.

Via Barchart.com · December 22, 2025

As the calendar turns toward 2026, Morgan Stanley (NYSE:MS) has released a highly anticipated market outlook that navigates a narrow path between structural optimism and valuation-driven caution. The firm’s Global Investment Committee (GIC) has officially set a year-end 2026 target of 7,500 for the S&P 500,

Via MarketMinute · December 22, 2025

The dollar index (DXY00 ) is down -0.30%, falling back from last Friday's 1-week high. The dollar continues to see underlying weakness as the FOMC is expected to cut interest rates by about -50 bp in 2026, while the BOJ is expected to raise rates by...

Via Barchart.com · December 22, 2025

Shares of Tesla Inc. (NASDAQ:TSLA) experienced a dramatic surge during Monday’s trading session, climbing over 6% to trade near the psychological $500 threshold. The rally comes as the electric vehicle (EV) pioneer approaches a critical technical "cup and handle" breakout point, a move that technical analysts suggest could

Via MarketMinute · December 22, 2025

In a move that has sent shockwaves through both Silicon Valley and the Sunset Strip, Oracle (NYSE:ORCL) co-founder Larry Ellison has effectively "lifted" the financial floor of the media industry. On December 22, 2025, the elder Ellison provided an unprecedented $40.4 billion irrevocable personal guarantee to back Paramount

Via MarketMinute · December 22, 2025

AMC stock is trending across social media Monday morning, trading flat after hitting a new all-time low, as investors digest recent corporate updates.

Via Benzinga · December 22, 2025

Is Rapport Therapeutics Stock a Buy After Investment Firm Cormorant Raised Its Stake Over $60 Million?

Via The Motley Fool · December 22, 2025

US eVTOL race intensifies as Joby, Archer face 2026 deadline. Joby focusing on scale and data, while Archer prioritizes city partnerships.

Via Benzinga · December 22, 2025

In a historic session that has redefined the landscape of global finance, gold prices officially breached the psychological and technical barrier of $4,400 per ounce on December 22, 2025. This milestone marks a staggering 68% year-to-date climb, cementing 2025 as the most explosive year for precious metals in modern

Via MarketMinute · December 22, 2025

It's difficult for rivals to compete with Coca-Cola's broad reach and deep product portfolio.

Via The Motley Fool · December 22, 2025

In a landmark shift for the global semiconductor industry, NVIDIA Corporation (NASDAQ: NVDA) has reportedly informed its Chinese clients of plans to begin shipping its high-performance H200 AI chips to the region by early 2026. According to a Reuters report published on December 22, 2025, the Silicon Valley giant is

Via MarketMinute · December 22, 2025

The deal could add over 3% to its first full-year earnings per share, Jefferies said.

Via Stocktwits · December 22, 2025

The S&P 500 climbed 0.4% on Monday, December 22, 2025, as technology shares spearheaded a broad-based market advance to kick off a holiday-shortened trading week. This gain extends a resilient three-day winning streak for the major indexes, signaling strong investor confidence as the year draws to a close.

Via MarketMinute · December 22, 2025

Paramount said Oracle founder Larry Ellison had provided an irrevocable $40.4 billion personal guarantee backing the financing for the offer

Via Benzinga · December 22, 2025

Via Benzinga · December 22, 2025

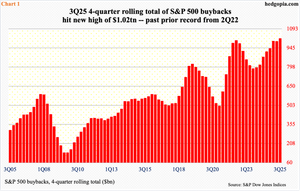

S&P 500 buybacks hit a new high in the 12 months to September. Buybacks, along with earnings and margin debt, have been key pillars of support in this bull market.

Via Talk Markets · December 22, 2025

Coinbase Global Inc (NASDAQ:COIN) projects stablecoins will hit $1.2 trillion by 2028 as crypto sheds its “Wild West” reputation and matures into institutional-

Via Benzinga · December 22, 2025

Silver Approaching The Magnet Please click here for an enlarged chart of Silver Trust

Via Benzinga · December 22, 2025

SOFI stock moved higher after the company launched its stablecoin, a move that expands its crypto ambitions beyond trading and into financial infrastructure.

Via Barchart.com · December 22, 2025

Jim Beam, an iconic American bourbon brand, is on hiatus in Kentucky due to global market conditions in the spirits industry.

Via Benzinga · December 22, 2025

March sugar futures present a buying opportunity on more price strength.

Via Barchart.com · December 22, 2025

FDA approved CYTK's Myqorzo for oHCM. It reduces heart's pumping ability, has a warning for heart failure and expected to launch in 2026.

Via Benzinga · December 22, 2025

Alphabet said the deal is aimed at bringing new power and data center capacity online faster to meet growing cloud demand.

Via Stocktwits · December 22, 2025

Via MarketBeat · December 22, 2025